Just when we thought it was over. As countries such as the UK finally looked like they may be emerging from the pandemic, Omicron has brought unwelcome uncertainty to the Covid crisis, which continues to escalate at an alarming pace.

Regardless, however, coronavirus will at some point become endemic. As governments around the world are now accepting, we will learn to live with it. As the year closes, it is a good time to look to the future. Part of that will mean we must stop blaming every supply chain problem on either the pandemic or Brexit.

The disruption we’ve seen to life science supply chains over the last two years has roots that go back much further.

At the outset, it’s important to recognise that life science supply chains do face significant and particular challenges. Like many modern supply chains, they are complex, and like many others, drug manufacturers face general pricing pressures, geopolitical threats, and a heavy reliance on outsourced manufacturers.

Like not quite so many, the failure in supply of key drugs can be life changing. Furthermore, like fewer still, they are very highly regulated. This regulatory environment is perhaps what differentiates them most.

That’s the background against which Covid has played out.

A crisis in demand

Turning to the crisis itself, we can make two observations.

First, even in the early stage of the pandemic, the most frequently cited cause of disruption was not the inability of supply chains to deliver– whether government restrictions on travel or movement, import bans or lack of available workforce as a result of illness or lockdowns.

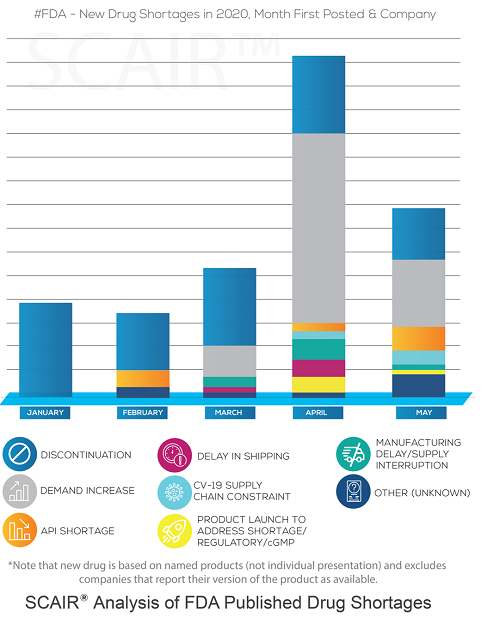

We know that because the FDA publishes drugs shortages and their root causes. Our month-by-month analysis of this data using our own supply chain risk management software SCAIR®, show that the number of drugs first reported as in shortage started rising in February and peaked in April. The most frequent cause, however, was not Covid-related constraints but increases in demand – by far.

In many cases, the shortages were for antivirals beings used to treat covid, as well as anaesthetics and sedatives used for mechanical intubation. That wasn’t just a US issue, either. The British Generics Manufacturers Association reported a five-to-tenfold increase in demand for intensive care medicines in the UK.

The key point, though, is that it was not the virus itself limiting supply. Supply chains were simply unable to respond quickly enough to surging demands. Covid effectively shone a light on this.

A long-standing problem

That’s even clearer if we take a longer view.

Look at the cause of shortages over the five years from 2013 to 2017. Over this period, there was no particular surge in demand, so that wasn’t the leading reason. But neither were there any natural disasters or major fire/explosion across those years.

Instead – and by quite a way according to the 2019 FDA Drug Shortages Task Force Report – most shortages were due to quality issues. This was the root of 62% newly reported drug shortages between 2013 and 2017: anything from a single contaminated batch of raw material through to a plant shutdown for systemic quality failures that can go for months. This data also shows that drug shortages have been with us for some time. Indeed, the peak in 2011 saw it recognised as a crisis and drug shortage task forces set up in the US & EU. But they’re still with us and on the rise again even before the pandemic. In 2017 the FDA reported 39 new drug shortages – up 50% up on 2015 and 2016. In 2020 there were 43, and the FDA worked with manufacturers to prevent 199 others.

So, drug shortages are nothing new, and they’re not usually the result of unpredictable natural disasters or other catastrophes, either. Instead, they’re due to fundamental and long-standing structural supply chain issues.

So why can’t we address these?

Long-term trends

To answer that, we need to look at the cause of those issues. They are varied.

One is that a broad range of drug supplies can be reliant on a small number of specialist supplier facilities. The 2020 Report to US Congress on Drug Shortages from which the above data is taken specifically mentions this: Several shortages in 2017 and 2018 were down to two large drug manufacturers closing facilities for remediation.

There are also longer-term trends that have made supply chains more fragile in the last two decades:

- Adoption of lean or just-in-time (JIT) manufacturing. These methodologies aim to cut working capital and make supply chains more efficient. The net result is leaner supply chains, lower stock levels and less in-built resilience.

- Outsourcing to countries with lower labour costs and, in some cases, less mature regulatory systems. Drug supplies have become dependent on fewer and, in some instances, lower-quality manufacturers.

- Increasingly global supply chains adding to logistical complexity, decreasing supply chain visibility, and increasing exposures to threats from more volatile regions.

The downside of regulation

There’s a final factor, too, though, and it comes back to that distinctive characteristic of life science supply chains: regulation. Pharma, biologics and medical device manufacturers all have to comply with a strict framework and stringent standards put in place to protect patients.

Few would argue with regulatory standards to ensure safe drugs and treatments. But tough regulations can, in practice, actually work against patients when something goes wrong. The loss of a critical supplier or manufacturer (possibly due to regulatory action itself) can result in lengthy supply shortages whilst regulators validate and approve an alternative.

Which drugs are most problematic?

It’s informative to look at which drugs are most likely to be affected, too. FDA data analysis shows that the drugs most often recalled over the past few years are generic injectables: Low margin drugs that are very difficult to make. Older drugs, approved many years ago (and therefore more likely to be near the end or out of patent), are also more likely to be recalled.

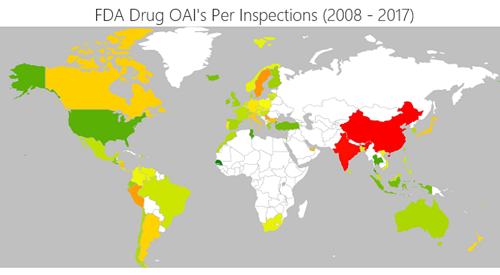

Furthermore, our own analysis from SCAIR®, shows that 69% of companies reporting shortages in the US experienced an adverse inspection (or an OAI “official action indicated” notice) in the preceding four-year period. Many of these resulted from problems with manufacturing in India and China. The chart below shows the percentage of companies in different countries that received an adverse inspection. Green is under five per cent; red is over eight per cent.

The reliance on cheap manufacturing bases seems likely to be closely correlated with the likelihood of quality failures and subsequent shortage.

Now what?

So, what can we do?

There are, perhaps, two answers. The first is for manufacturers. They are unlikely to predict the precise circumstances of a shortage: It will probably stem from a series of unlikely events coming together. They can, however, identify their most vulnerable supply nodes and then make contingency plans to respond to an interruption or disruption to these, regardless of the cause.

With potentially thousands of suppliers, focusing on those key vulnerabilities requires a systematic approach:

- First, filter down the list of suppliers to identify the most critical. The criteria used will vary, but uniqueness will probably weigh heavily. Those without alternatives are inherently more critical.

- Then focus on high revenue products and map internal and external supply chain relationships, relating each critical supply node to the product sales it contributes. This enables us to put a number on the value at risk should a supplier be lost.

- Overlay the threats and scenarios that could affect supplies. For each scenario – such as a natural disaster in a particular area – we can then estimate the actual financial impact of the loss of a supply node across the portfolio of products.

- Finally, for each scenario, consider and justify mitigations and optimise risk transfer decisions. This involves a cost-benefit analysis of mitigations such as holding strategic stock, validating alternative suppliers or investing in business interruption insurance.

The price of resilience

From the manufacturers’ perspective, this is complex but achievable. Some years ago, a survey by consultants KPMG found only nine per cent of respondents believed their organisation could assess the impact of a supply chain disruption in a matter of hours. Almost one in five (17 per cent) said it took three weeks or longer.

Modern technology has improved that; the challenge is often now too much data rather than too little. Identifying critical vulnerabilities so that they can be mitigated is possible. The question is, can investing in contingencies be justified?

New, in-patent products have the margins to support investment in stock, secondary suppliers and other mitigations that ensure high quality, resilient supply chains. Many critical generics with low margins – and especially those with complex production processes – do not.

In the last 18 months, the pandemic has seen a surge of state funding into medicines innovations and research. There has also been significant public/private investment in the biologics supply base. Governments have been forced to look at their supply chains, and many have invested in critical infrastructure to leave them less dependent on foreign manufacture.

As yet, though, most of this work has not addressed the price dynamics and vulnerability that characterise many generics’ supply chains. Regulation that ensures the highest patient safety standards is invaluable, but it does have a cost, and somebody has to pay. Until governments and societies grasp that nettle, it will often end up still being the consumers who find they struggle to get the drugs they need.