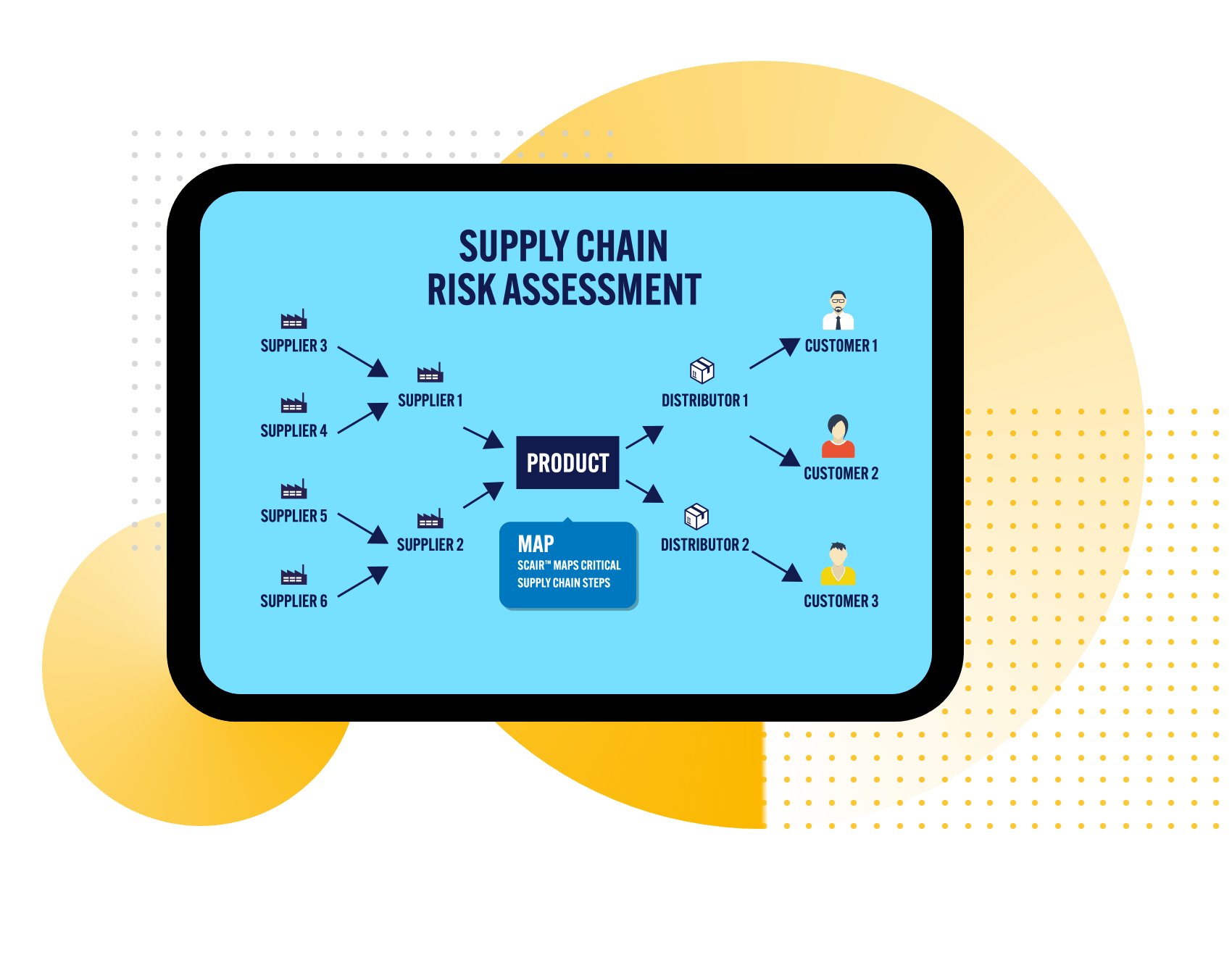

Who uses SCAIR®?

From supply chain managers to insurers, find out why SCAIR® is a business critical tool

Supply Chain Risk Managers

- Justify mitigation spend (cost-benefit analysis) and resist the push to reduce safety stock by putting a value on supply chain exposure.

- Make better decisions by converting flat Excel files into dynamic, user-friendly maps that reveal supply chain vulnerabilities.

- Get an accurate picture of exposures in single locations by viewing total exposure by site rather than material.

- Improve supplier vulnerability analysis by taking outputs from the materials management system and consolidating them by supplier location.

- Present a true picture of single supplier dependency and vulnerability by targeting the manufacturing location (rather than a distributor or agent).

- Stay ahead of the competition with alerts on issues that impact your critical suppliers, for instance, non-compliance and natural hazards.

- Get customised, targeted reports using PowerBI.

Insurance Managers

- Generate accurate, realistic business interruption values to enable more efficient insurance buying.

- Optimise insurance procurement by getting the right suppliers on cover with the right limit – and only buy cover where you need it.

- Reduce costs and reliance on specialist insurance/supply chain risk consultants.

- Estimate the true magnitude of exposure across a range of risk scenarios: fire, flood, earthquake, regulatory closure and insolvency to accurately estimate accumulations for different types of risk*.

- Generate exposure-by-location data and use it with Monte Carlo analysis to understand the financial impact of risk and uncertainty at single sites.

- Determine the value of investment in mitigations by comparing pure and mitigated risk.

- Compile accurate exposure profiles without insurance-specific data – existing business information can be used with SCAIR to deliver accurate results.

*For example, an earthquake would accumulate exposures for different locations that share the same fault line; an insolvency scenario would explore the total company-wide exposure across different locations owned by the same organisation.

Management Consultants

- Accurately analyse your life sciences client supply chain risk with a tool specifically designed for their industry.

- Assess your client’s financial, physical and regulatory exposure profile in the wake of a prospective takeover.

- Undertake due diligence by generating a complete report on the risk quality of your client’s supply base, using regulatory non-compliance history.

Business Continuity Managers

- Make better, more informed decisions by converting flat Excel files into dynamic, user-friendly maps that visualise supply chain vulnerabilities.

- Create customised reports with exactly the right level of detail using PowerBI.

- Enhance visibility of exposures to single locations by getting a picture of the total exposure by site rather than material.

- Get an accurate estimate of value at risk. No need to rely only on straight revenue dependency by material – consider supply chain mitigations (alternative sources and stock) to get a more targeted gross profit exposure.

- Develop an accurate picture of downstream stock protection. Link suppliers to production sites and get SCAIR to calculate the total downstream stock that mitigates the exposure.

Insurers

- Help clients optimise the value of insurance cover by generating accurate, realistic business interruption values.

- Track BI location accumulation across the book to avoid any unpleasant surprises in the event of a loss.

- Assess a prospect’s financial, physical and regulatory risk profile to ensure they are high quality in terms of risk, or priced accordingly for less desirable risks.

- Save time generating loss exposures by taking data from a standard PDBI application form and generating exposures by site.

- Adjust clients’ premiums as appropriate – visualising year-on-year changes provides an understanding of variation in annual renewal data.

Procurement Managers

- Develop a true picture of revenue dependency by focusing on value/revenue at risk (by product/brand) rather than spend per supplier.

- Improve supply chain visibility and risk decisions by relating materials to the brands they serve.

- Understand total exposure to a legal entity by tracking risk accumulations by supplier location and then rolling them up by supplier entity.

- View material risk accumulations by category / sub category – this aligns with the typical procurement organisational structure and feeds into existing business reporting units.

- Get an accurate picture of downstream stock protection by linking suppliers to production sites.

- Keep a watching brief on non-compliance incidents in the supply chain and natural hazard alerts.

Corporate Reporting

- Ensure full disclosure by keeping a watching brief on non-compliance incidents in the supply chain.

- Adhere to mandatory Climate Change Financial Disclosure requirements by using exposure data to quantify risks associated with climate change.

Strengthen Your Supply Chains with SCAIR®

Talk to a supply chain risk expert now