Technology Will Transform US Pharma Supply Chains: and Data and Analytics are Central to a Government Drive for Resilience

There seems little doubt that regulation is coming for the pharma industry’s supply chain. As previously discussed, the Department of Health and Human Services (HHS) Essential Medicines Supply Chain and Manufacturing Resilience Assessment published on May 23 stems from one of the early acts of the Biden-Harris administration. Indeed, the writing has been on the wall from the moment Covid struck and limited supplies of essential drugs globally – even if that was sometimes more of a product of soaring demand than disrupted supply.

In fact, the seeds of a broader, more interventionalist approach to critical supply chains predate even that. In the early weeks of Trump’s presidency, the US was already looking at a more protectionist future, with the head of the President’s National Trade Council outlining its intention to repatriate international supply chains.

“It does the American economy no long-term good to only keep the big box factories where we are now assembling ‘American’ products that are composed primarily of foreign components,” the Financial Times reported him as saying.

“We need to manufacture those components in a robust domestic supply chain that will spur job and wage growth.”

Given the shock to supply chains from Covid, it would be surprising if moves towards reshoring were not seeing a renewed sense of urgency – particularly of what it has determined are “critical goods, products, and services”, as Biden’s Executive Order 14017 puts it. That’s all the more so when 87 per cent of API facilities for the generic drugs (which represent 90 per cent of US prescriptions) are overseas.

Supply Chain Challenges

But if the HHS report is part of a longer-term move toward a more prescriptive approach to supply chain resiliency, that doesn’t mean it’s nothing new. What it gives us is significant on what the US government sees as the key challenges and potential solutions to the resiliency of the pharma supply chains. It’s worth taking these in turn.

In terms of the challenges, it identifies at least six:

- The market structure – “such as downward pressures on costs for generic medicines and the common use of just-in-time inventory practices”, as it says;

- global competition that puts domestic pharma at a disadvantage, including foreign government support and lower offshore operating and labour costs;

- workforce issues, particularly around skills shortages and wage competition from other STEM fields;

- manufacturing issues, including “outdated and inefficient” equipment and processes making it difficult to respond to shifts in demand or supply disruptions;

- Distribution issues around communication, transparency and coordination that “impede efficiency and strategic decision-making”; and

- US regulation limiting flexibility or cost-effectiveness for domestic manufacturers.

What’s noticeable about this list – and explicit elsewhere in the report – is that while some issues may be for the government, much is going to be down to the private sector. Most obviously, regulatory matters and perhaps STEM education might be primarily down to legislators (although even here, there will be a role for business). For much of the rest, businesses have a significant role to play – and, as we’ve said, are increasingly likely to have regulatory obligations.

Supply Chain Risk Assesment Tools Boost Visibilty

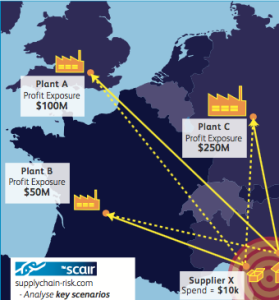

That’s perhaps particularly true of the first solution strategy the report puts forward: increased supply chain coordination, security and transparency.

The benefits of this are apparent. As it states, “Improving supply chain visibility will offer a greater ability to anticipate, prioritize, and respond to critical issues, demands, and potential disruptions.”

It says this can be achieved in several ways. One is “Expanding [the] use of data, analytics, and predictive tools to mitigate and manage risk.”

It goes on to suggest several strategies to pursue, with, again, a mix of public and private sector efforts involved. These include improving data sharing and standardisation, strengthening public-private collaboration and coordination and establishing a more comprehensive “centralised control tower platform”, including developing a national critical drug tracking, monitoring and alert system. It also emphasises the importance of physical and cyber security throughout the supply chain.

Quite a number of these plans – particularly those involving the public sector will take time. Strikingly, though, some are readily achievable in the near term. It will probably take time to create the shared data infrastructure for government agencies and supply chain stakeholders that the report suggests.

However, the private sector can already start to gather that data and – at least for their own business, use data analytics to identify the key risks and vulnerabilities in their supply chains.

Solutions like SCAIR® already exist to map, monitor, and analyse critical supply points and relationships. This can help create more resilient supply chains and better business decisions around mitigation and contingency plans.

The HSS report makes it clear this is the direction of travel in efforts to boost pharma supply chain resilience. The winners, as the US and other countries reshape their critical supply chains, will be those that start on the journey now.